Pre-Post - Creating Finance Records In Post Manager

Pre-Post - Creating Finance Records In Post Manager

Please Note: This article applies only customers with the Pre-Post module enabled. For existing People+ customers click here for information

Finance records are used to define

- How staff with a certain post should be paid (Payroll or Invoice)

- Salary and Shift payment

- Pension details (if applicable)

To create a Finance Record, select the relevant Post contract, navigate to the Financials tab and click the add button

This will take you to the Add Finance to Contract screen where you will be able to select the payment type for this post - you will need to decide if pay for staff with this post should be Payroll or Non-Payroll (Invoicable). This will affect whether staff with this Post will show in Payroll or Invoicing Exports (Finance+ only).

Please note that NONE of the following is mandatory. Clicking Save at this point is enough to create the Finance Record, which can be edited later/left blank.

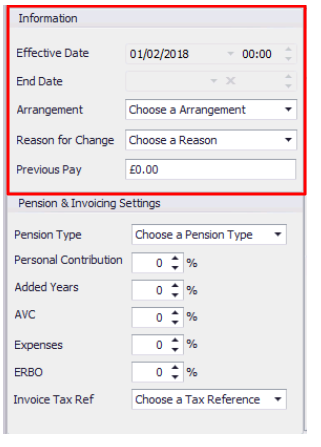

- Effective Date - the date that this Finance Record will be effective. If this date is set to a future date, staff with this post will not be able to work any shifts before the Effective Date.

- End Date - the end date for this Finance Record. This is usually set when ending a post, or for a fixed term contract.

- Arrangement - this list is set in Post Settings and represents the finance arrangement (TUPE, etc)

- Reason For Change - if this is a new finance record this is unlikely to be used, but represents the reason for a change to a Salary/Finance Record. Reasons are set in Post Settings.

- Previous Pay - can be used to record previous salaries

All Pension settings only come live when 'Non-Payroll' is selected, so that Pension contributions can be recorded (and reported on) for non-contracted staff.

- Pension Types are GP SOLO and GP Pooled - select the appropriate one

- Use the % boxes to record contributions of each type

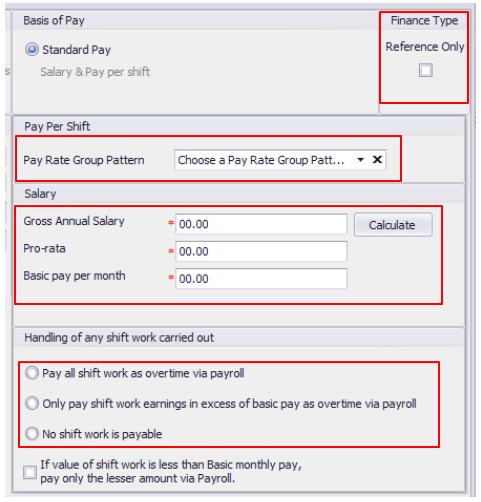

Finance Type - Reference Only - this finance record will not calculate any shift values/be used in Finance areas of the system and is for HR reference only when ticked

Pay Per Shift - a Pay Rate Pattern can be assigned to a Finance Record, so that shifts worked by staff with this post will be paid according to the pay rates set in that pattern.

Salary - Salaries can be outlined in terms of;

- Gross Annual Salary - the full time annual salary for this post

- Pro-Rata - based on the Contracted Hours outlined in the contract and the 'Hours in a Working Week' defined in the Rota Group settings, the system will calculate the pro-rata equivalent

- Basic Pay Per Month - 1/12th of the pro-rata salary

Handling of any shift work carried out - This section is used when a Salary is recorded to work out how to pay Shift Work in the system.

- Pay All Shift work... - All shift work will be payable by the Pay Rate assigned to the shift (or the Pay Rate Pattern if defined above)

- Only pay shift work... - Only shift values that take the person above their Basic Pay Per Month amount will be paid on top of the basic salary via Payroll exports

- No Shift Work Is Payable - Only the Basic Pay Per Month will come off in Payroll exports, regardless of shifts worked.

- If the value of shift work... - If a person with this post earns less (using shift pay) in a period, ticking this box will mean that they get paid less than their Basic Pay for that period.

Once the Finance Record has been configured, click Save. This will take you back to the Contract screen - click Save on that screen too to return to the Post.